When the Covid-19 quarantine began, I was quite sure my ambitious spring travel plans were over, and I was also convinced that the demand for Patek Philippe was going to abruptly end. I expected people would sit at home, put money under their mattresses rather than on their wrists, and Collectability would focus on collecting money for outstanding invoices rather than collecting watches for the site. Day one of the quarantine confirmed my views: business stopped. However, by the end of the first week of the greater New York area quarantine, something strange happened. The phones were ringing off the hook and dozens of emails were pouring in from around the world with collectors asking what we had in stock and what was in the pipeline. It was a surprising and unexpected development. The same statements were made by potential buyer after buyer: “What do you have in stock?”, “How much and how fast can you ship?”, “Are you still open for business?”, and, “I am so bored”.

Oddly, another trend developed. Early in the quarantine we started selling Patek Philippe clocks at a ‘record’ level. We had over twenty Patek clocks in stock and suddenly found we were down to only a handful. Then the completely unexpected happened: we started selling Patek Philippe pocket watches. I have been predicting an uptick in the interest in Patek pocket watches for decades but never expected it would take a pandemic to spark appreciation for some of the best value buys in the watch world. I asked my clients why the sudden interest in clocks and pocket watches and the reply was the same, “I am not going out anytime soon so I might as well enjoy these timepieces in the comfort of my own home”. It seemed to be a classic Patek sentiment being executed in the purest way: buying a timepiece for personal enjoyment without the need to impress anyone else.

As the quarantine marched on, it was clear that people were bored, very bored. Memes were being sent endlessly, online traffic was spiking, and many watch aficionados found themselves hungry to take the time to learn more. Soon IG live and Zoom calls were full of horological chatter 24/7 and Patek Philippe was and remains a hot topic. New scholarship was being shared with a wider and larger audience as Watchonista, Hodinkee, A Collected Man, etc. were sharing educationally focused content. Nothing too different than in the past, except the reader base was larger and took the time to digest the content. Even Collectability’s traffic has had some impressive spikes as existing and new collectors visited the website to help continue building their obsession.

Asking other watch dealers, on and off the record, I have heard some surprising trends about Patek Philippe in the vintage and secondary market. Patek Philippe sales are hot. Sure, some modern, pre-owned references are 5 – 10% off their high from two months ago but others keep on marching upward.

According to Mike Manjos, VP and Chief Revenue Officer at WatchBox, “We are seeing the traditional ‘over retail’ hot Pateks have cooled off a bit during the quarantine but 5070s, 5170s, etc. are still trading strong. 5970s in particular have gone up and are difficult to find. A year and a half ago we had eleven 5970s in inventory and now only one. Overall, Patek Philippe prices have held up shockingly well. Current production watches will take a hit once the retail stores reopen and retailers will make up for lost time. There will be lots of modern goods on the market. However, we have sold 8M USD in the last 6 weeks while the world shut down. Patek prices are not falling and watches are trading. With no new modern Rolex or Patek hitting the market, vintage and pre-owned Patek is strong since there is a shortage of watches for sale and everyone is shopping online. The growing interest in vintage Patek is a flight to safely, and we saw the same thing happen during the 2009 downturn. Second tier watches dropped off the map and the best watches sold well.”

For vintage Patek Philippe watches, this is where the action has been surprisingly positive with prices for the best pieces going steadily upward. It is too soon to say if this trend is permanent, yet history has proven that Patek Philippe can weather almost any storm and has a way of becoming stronger the more turbulent the overall economy. A senior manager at Patek Philippe with whom I had the pleasure of working with, would often say that Patek Philippe does better during an economic downturn than boom time. Why? Because during a boom time, Patek cannot meet demand, clients are frustrated to be put on waiting lists and disappointed not to be able to purchase the watch of their dreams. During a downturn, Patek clients can buy the pieces they have been waiting for and are much happier. This sentiment exemplifies the power of Patek Philippe and the relationship it has with its clients.

For the retailers, the last few weeks have been brutal. Brick and mortar has closed. Some family retailers smoothly pivoted to online sales; but for others that was not a possibility, nor part of their business model. Patek Philippe regionally offered the ability for retailers to sell online very early in April but this practice was met with limited success. The whole idea of buying a Patek Philippe from an authorized retailer is founded on the ability to meet and discuss in person and create an experience of learning when buying the world’s finest watch. It’s not the same with a screen. However, where there’s a will there’s a way, and many retailers have found ways to connect digitally with their clients and continue to close sales. Yet the numbers are dismal compared to past years. For modern Patek Philippe watches, it is a supply and fulfillment problem but the demand is still there.

According to Marc Berliner, a well-known watch collector and film/television producer, “With the stock market and traditional investments volatile at best, I think people with money are turning back to tangible assets. With so much uncertainty, people are looking to buy things that they can see and hold. They are asking ‘what if things don’t get better?’ and ‘what if I get sick?’ This thought process drives people to buy something of real and lasting value such as a Patek Philippe. People are looking to buy hand-finished timepieces that are legitimately rare and precious.”

With the demand for Patek Philippe growing, customers are looking for ways to buy Pateks from trusted sources and many are opening their eyes to vintage watches for the first time. With retailers closed, and the market for modern Pateks becoming an online commodity market where the best price wins, the value proposition for vintage becomes increasingly clear. Incredible variety in designs, enticing price points, wear-ability, and relative liquidity make an enticing argument for vintage. People like to buy things that they believe they can sell for the same price or more down the road and Patek Philippe had weathered the storms of the past and present better than any other brand in the watch world, and arguably better than any other luxury asset class.

For the major auction houses, this should be a major opportunity to step in as an expanding global trading floor. With internal expertise, global markets, and deep client lists of retail and dealer buyers and sellers, this is a ready-made recipe for success. However, the last few weeks have shown almost the entire shutdown of the traditional auction house market. Some of the houses have pivoted to different degrees to embrace a more digital business than in the past. Sotheby’s was the first to launch its weekly online watch sales, a brilliant step to keep business moving with New York, Geneva, and Hong Kong hosting sales.

Christie’s also continued to have online sales and boldly announced mid-pandemic a major live sale that is planned in Hong Kong on July 13. Phillip’s recently announced its first ever cross cross-category online auction, featuring 20th Century & Contemporary Art, Watches and Jewels. Also the spring Geneva sales are still slated for the end of June but are subject to Covid-induced schedule changes. The one thing all of these house’s offerings have in common is a focus on Patek Philippe, the food that a hungry market is waiting to order for delivery.

Now, with summer 2020 around the corner, a new trend of buyers is emerging. ‘Second-wave’ buyers are starting to see the relative resilience of Patek Philippe over the past two months and they are eager to join the party. New buyers are coming to the Patek Philippe table for the first time buying to park assets with the hope of stability and even appreciation. The most common sentiment that I hear is, “At least I can wear and enjoy a Patek Philippe while other asset class values are wiped away”. Many of these new buyers are focused on pre-owned modern and current production Patek Philippe and some are delving into vintage for the first time.

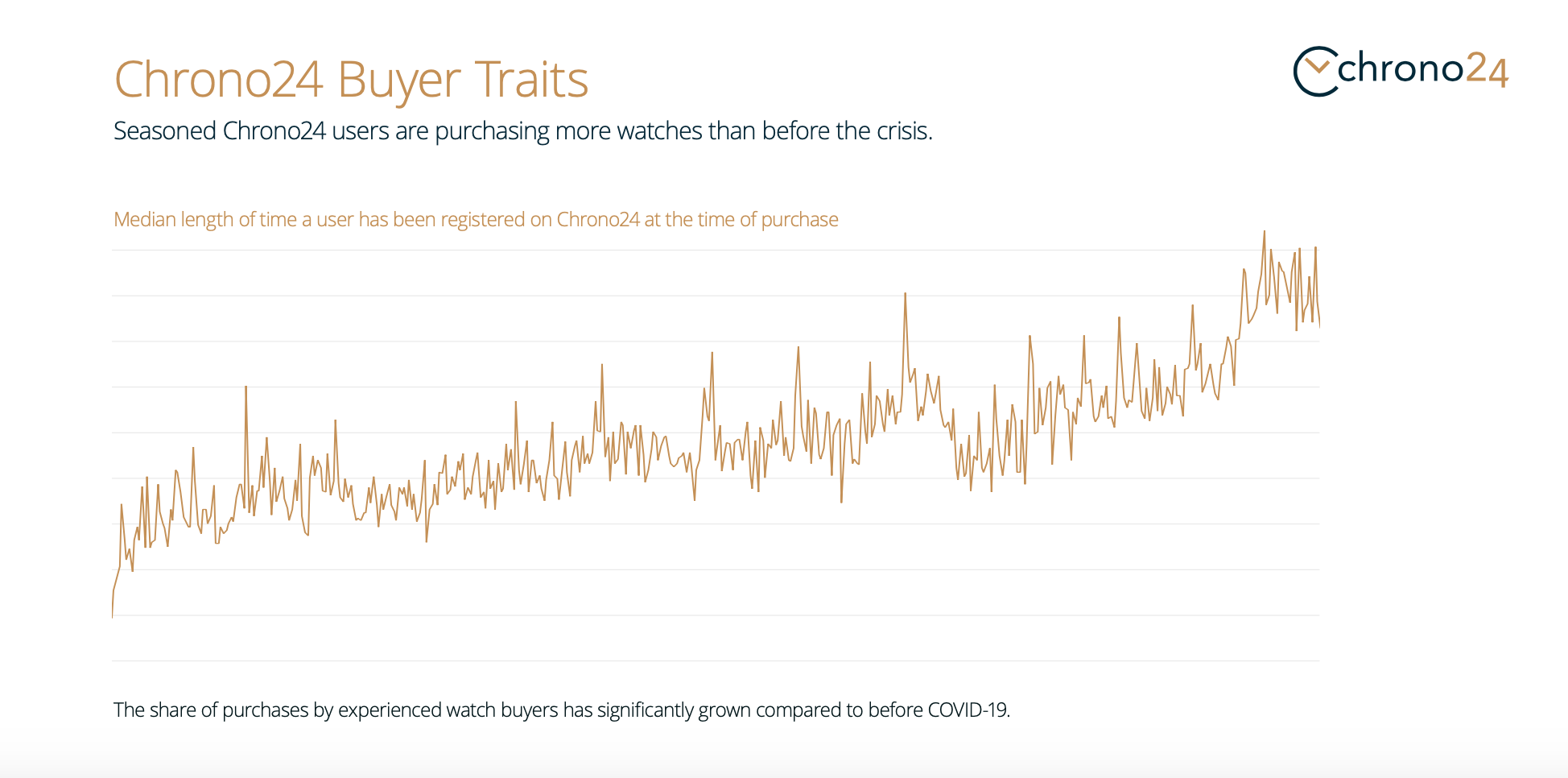

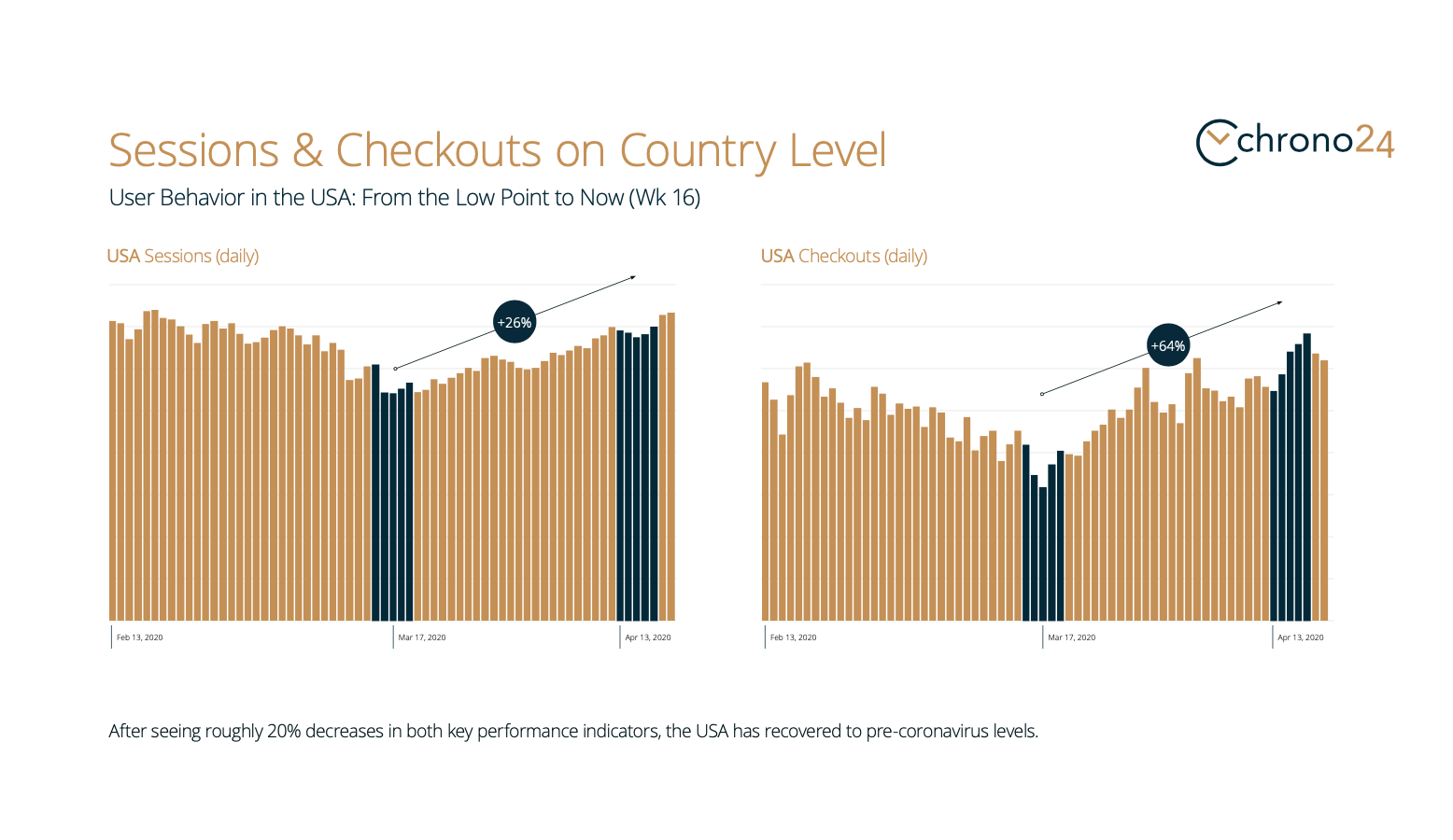

These market trends are supported by a detailed report by online pre-owned watch market leader Chrono24 using its robust global data base. Underlining a trend that we are hearing from dealers here in the United States, Americans are buying watches online at levels that no one had ever seen before. From the market low on March 17, Chrono24 has seen a 26% increase in US visitor sessions. More impressively, Chrono24 has seen a 64% percent increase over the same period of US based purchases. Source: Chrono24 The State of the Global Watch Industry, No. 2, April 29, 2020 ‘Trends in Global Watch Buying and Selling in Light of the Global Coronovirus Crisis”.

As the metrics are shared over recent transactions from Q2 2020, it is becoming quite clear that Patek Philippe (and Rolex) are separating from the pack as the most desirable watches in the world. The rules of ‘how’ and ‘why’ people are buying are changing by the minute. In the near future we will know if this trend will continue or if this is just a market anomaly. At the end of the day, when one needs to choose between a meal on the table or a fine watch, the decision is clear. However, once needs are met and money cannot be spent on vacations or spontaneous shopping trips on 5th Avenue, the value proposition for Patek Philippe is quite compelling and the story of ‘Patek in crisis’ is once again being retold, repackaged for the next generation.