In the midst of such a difficult and challenging global situation, many of us within the watch community are relying on each other in the most unexpected ways. Right now, the watch world is banding together digitally, especially with WhatsApp, WeChat, Instagram and the various brand chat rooms on the web. And of course, the watch memes that are born out of such digital GTGs can result in some creations that are sometimes unforgettable, sometimes true, sometimes far-fetched and sometimes in between. Recently, I saw a meme circulating showing a man crying that his Patek Nautilus Ref. 5711/1A was now worth only two and a half times retail, rather than three times the original price. At times such as this, there is often a small bit of truth in the humor. That said, let’s look at how various crises have affected the watch market historically from the Patek Philippe perspective, and then look at five things you should do now to weather the coronavirus storm from a watch perspective.

Historically, Patek Philippe has survived crisis after crisis in both a brilliant and bold way. The laws of supply and demand seem to always find a way of bringing a Patek Philippe timepiece back to its correct relative value, at least it has so far over the last 180 years. Take for example the Financial Crisis of 1847 and European Revolutions of 1848, this was not an easy time for the nascent Patek company. However, Antoine Norbert de Patek used this period to restructure his company and build for the future as he creatively developed new markets and demand for his watches. With the gold standard in full force in the US, time was literally money with Patek Philippe watches, or any gold cased watch for that matter.

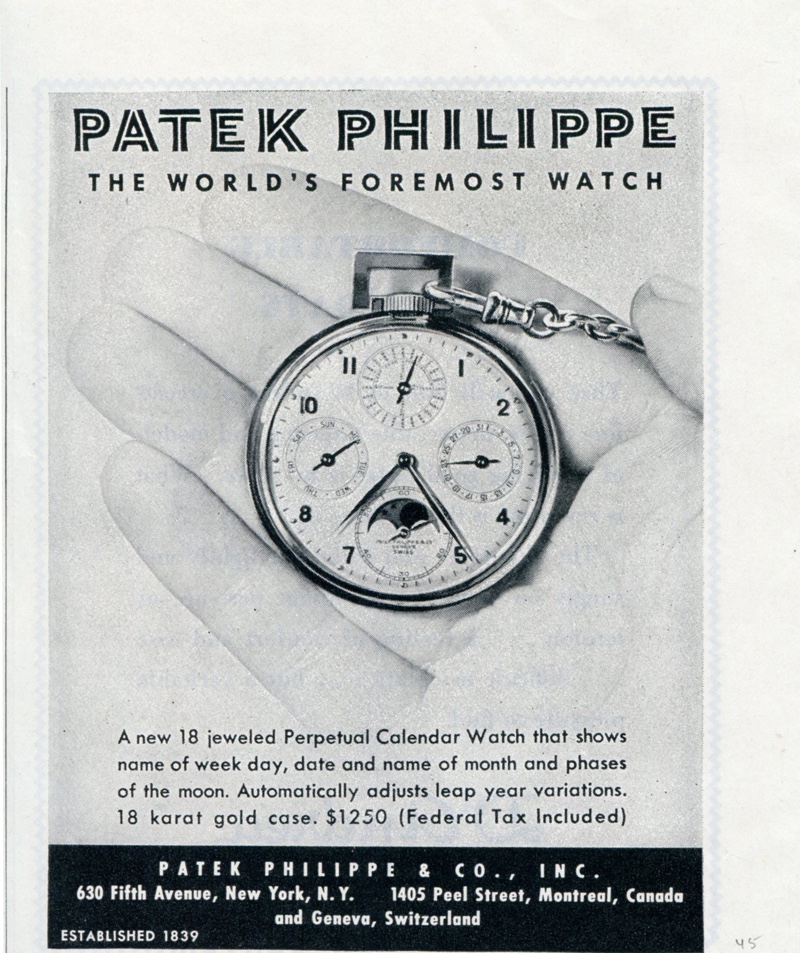

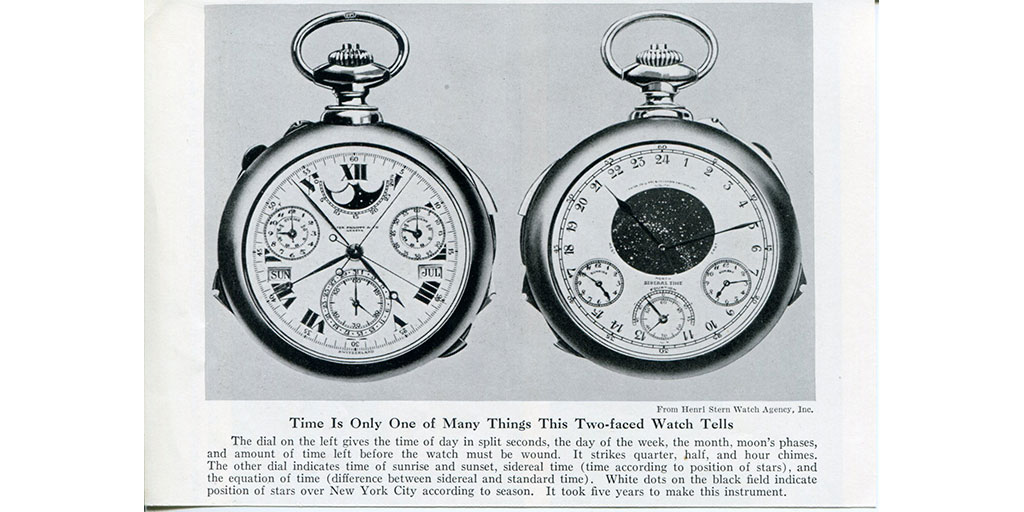

Fast forward to the Great Depression, and once again we see Patek Philippe doing everything possible to survive — and literally becoming stronger in the process. Following a dramatic change in ownership when Charles and Jean Stern bought the company in 1932, the brothers laid the foundation for growing Patek Philippe into a global powerhouse. During this difficult era, clients of the firm such as Henry Graves, Jr pushed the company to make horological masterpieces the world had never seen before. For Graves and other important watch collectors, like James Ward Packard, Patek Philippe timepieces seemed the logical place to keep assets secure for not just enjoyment, but for relative financial security. At the end of the day, at least these collectors had their watches to enjoy, even with the drastic fluctuation of financial markets.

During the oil crisis of the 1970s, Patek Philippe marketed the lasting value of their watches in a world that was overrun by ‘stagflation’. Patek Philippe watches were looked at as a form of portable wealth in an unsecure environment. In the Middle East, and the rest of the world, buyers of Patek Philippe were convinced they had something of ‘real’ and of lasting value. Time has proven that they were right.

More recently, the financial crisis of 2007 – 2008 is fresh in our minds as the Great Recession took hold and greatly affected the watch market. Not surprisingly, Patek Philippe was at the forefront of the idea of value retention during difficult times. Take a look at every auction during this period and Patek Philippe performed quite well relative to prior years. And the values that these same watches brought afterwards over the past decade is equally impressive.

For example, at the Christie’s Geneva sale in 2008, the Briggs Cunningham stainless steel ref. 1526 brought over 4m CHF with an estimate of 1.5 – 2.5m CHF; while the exceptional ref. 3448G brought 361k CHF on an estimate of 250-350k USD. Fun to imagine what they would bring today, and a safe bet is to assume far more than in 2008.

As the world enters a time of uncertainty in the coming days and weeks, it is important to remember the world has survived many seemingly insurmountable crises before, and Patek Philippe watches have proven time after time to be a solid place to be ‘invested’. These watches remain here for us generation after generation, to bring us pleasure in collecting, and a gentle reminder that things may be different in the future, but odds are they will also be better. As the major auction houses cancel their live auctions, and all the major watch shows are also being canceled, many in the watch community have unexpected time on their hands to think about these precious horological works of art. This ‘extra’ time can be used to step back and assess the true value of collecting, the people within our community, and how best to care for our collection.

Here are five things you can do now to weather the coronavirus storm (from a Patek Philippe watch perspective).

- First and foremost, your health is your wealth. Look out for yourself and loved ones during these difficult times to stay safe.

- If you have some free time during this period of social distancing, take the opportunity to research and learn more about watches. Catch up on your Patek Philippe reading with the list of books here and of course the Patek Philippe website. Collectability can also provide additional Patek Philippe reading. We have been told that it takes over four hours to read all the articles on our site and much more content will be added in the near future.

- Update your valuations and insurance for your collection. This is something that should be done annually, and don’t forget to label and organize all your boxes, papers, extra case backs, etc. This is often overlooked but should be done to best protect your collection.

- Assess the storage of your collections to make sure everything is safe and secure. Most commonly, I see water and humidity damage to certificates and boxes. Use zip lock bags to protect your watches and ephemera against moisture damage and keep your collection well organized and stored securely when watches are not on your wrist. If your watches are stored in a safe deposit box at a bank, make sure they are documented, and that all auto-deduct payments for your safe deposit box are updated as appropriate. Also keep in mind that safe deposit boxes are not insured unless you take out your own policy.

- Last but not least, look for buying opportunities. Many dealers are selling down their inventories and many astute collectors are jumping on the chance to buy a great Patek Philippe timepiece at an attractive price. No one knows where the watch market is going in the future, but it is nearly always a safe bet to buy a great watch at a great price.