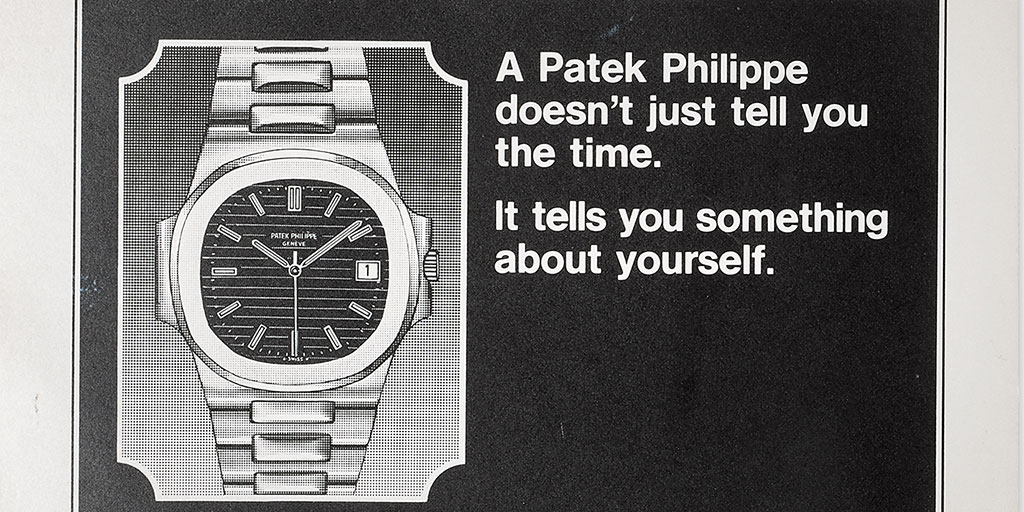

Ten years ago, it was quite easy to find a modern steel ref. 5711/1A for under 15,000 USD. If you were lucky, you could have picked one up for even less. Back then it seemed like business as usual for the Nautilus, a staple in the Patek line since 1976. Then something strange happened.

It was December 7, 2017 and I was speaking to a potential bidder ahead of an auction in New York. There was a ref. 5711/1A in the sale and this potential buyer wanted it badly… and I mean very badly. He left a bid that I cannot share but let’s just say that he was going to buy the watch no matter what happened in the room that night. Fortunately for him, the underbidders were reasonable and stopped at 32,000 USD meaning he walked away with the watch at 35,000 USD hammer (43,750 USD all-in); a respectable but market appropriate price at the time. I always wondered what would have happened if the underbidders pushed him further, if a ref. 5711/1A sold for 100k, 200k or even 300k USD?

If that had happened, I think the Nautilus craze would have received a nuclear acceleration that the world was not ready for. However, it was a precursor to a new generation of Patek collectors who were ready to go the extra mile to obtain the watch that was becoming quickly unobtainable.

An all-time price high

Fast forward to spring 2019, the high-water mark of ref. 5711/1A prices, and a black dial ref. 5711/1A was easily selling in the 80,000 to 90,000 USD range. Add a Tiffany signature to the mix and that price quickly doubled to 160,000 USD plus. For a watch that one could buy full retail for under 30,000 USD, these prices were rising to a level no one ever expected.

All of a sudden, everyone who owned one had the cozy feeling they were the smartest people in the world. And some true collectors smiled in the confidence that they would keep their Nautilus no matter what, watching with amusement from the sidelines as the speculators played in the sandbox. Others were keen on taking advantage of the situation, literally lying, manipulating and, sadly, even bribing authorized retailers in order to get their hands on a ref. 5711/1A for retail price.

The Insta element and FOMO

Insiders at Patek Philippe started to cringe as they watched this uncontrollable situation unfold. Retailers were unable to deliver the Nautilus to their most valuable clients and long-loyal consumers became frustrated that they had no chance to buy these ‘unobtainium’ watches.

All of this was fueled by Instagram. I’m not blaming IG but simply observing that this is the best platform to get the word out that there is a product you cannot buy unless you are ‘important’ or have the money to burn to bypass the normal distribution channels. Soon everyone had the fear of missing out if they didn’t have a Nautilus and even I felt like I had made the big mistake by not buying a ref. 5711/1A when I had the chance.

Sellers’ market

A feature in the New York Times by Nazanin Lankarani, dated March 20, 2019, exposed the truth about the ref. 5711/1A in an article titled “It Could Take 8 Years to Get This Patek Philippe. If You Can Get on the List”. Take the time to read it and judge for yourself. The illustrated image of a ref. 5711/1A surrounded by stars with people desperately reaching upward in a frenzy, is unforgettable. It was an incredibly informative article. However, it further popularized the notion that there is a product out there that everyone wants and no one can get. And one way to ensure someone wants your product is to tell them they can’t have it.

When I was a kid, I obsessively collected baseball cards. My ‘unobtainium’ was Mark McGwire’s 1987 Topps rookie card. I traded and bought my way to owning nine of these grail cards and seriously believed that I could put myself through college by eventually selling them. However, reality set in as the baseball card market prices started to depress in the 1990s and of course, the steroid scandal with certain beloved players didn’t help either. In the end, the collection I thought was worth 900 USD was suddenly worth less than nine. That hurt.

Market forces on overdrive

Now comparing a Patek and a piece of cardboard is not really fair. However, the market forces at work are the same. All my friends wanted this card; so did I. It appeared at the time to be the safest ‘investment’ in the world since these cards were impossible to find and demand was seemingly insanely high. Back then information traveled at a snail’s pace in a pre-digital world so the sell-off was slow and steady. Today, when information travels at lightning speed, we are seeing the market responding before our very eyes in real-time. Soon, we may see a ref. 5711/1A sell for a ‘normal’ price at auction and then every single investor with a sealed ref. 5711/1A hidden away will dump their watch on the market and the supply will far outweigh the demand. Remember the ref. 5960Ps selling for 88,000 USD in early 2008? That didn’t last long.

I’m not trying to instill fear or to encourage people to sell off their prized Nautilus watches, but to remind readers that we are talking about ownership, not investment. Prices will rise and fall but, whatever happens, you will still have a gorgeous watch on your wrist. (In a later post, I will write a homage to this incredible reference.) We should buy for the love of collecting, not to make money. Every collector I know who has bought from the heart the best examples they could afford has won, while many investors I have seen, who try to time the market, fail miserably.

Buy to love, not to sell

In the end, my cautionary tale is to buy what you love. Study every last detail of the watch and know exactly what you are buying. Understand the real market, not just the perceived market. Realize that watches may not be as liquid as you hoped when it is time you sell. And ultimately, buy the seller as much as the watch itself. This is what Collectability is all about.