The Collectability team recently returned from the Autumn Watch Auctions in Geneva, and the seasonal ‘World Cup’ of horological auctions did not disappoint. As the major auction houses presented their flagship sales and duked it out for auction supremacy, hundreds of collectors, dealers, observers, media, influencers and watch fanatics converged in Switzerland for a few days to watch hundreds of watches hit the auction block. We were of course most interested in seeing how the Patek Philippe vintage and modern pre-owned market is fairing and hopeful that we could pick up a few pieces in the process. We were pleasantly surprised that Patek Philippe was robustly strong — since we were outbid on everything we wanted! — but also observed some fundamental shifts, corrections and buying opportunities at auction during this important sale week. At auction, there are always pieces that seemingly go for too much and other pieces that seem to be absolute bargains. Only by being in each auction room and comparing and contrasting can we attempt to bring logic to the seemingly illogical world of Patek Philippe at auction. One thing is for sure, Patek Philippe remains the king at auction and the blue chip of blue chips. Although what sells and for how much at auction only offers a small insight into the vintage market, it is a good benchmark for the moment. Here are five key observations from the Geneva sales and our attempt to make sense of the results.

‘Modern Vintage’ Perpetual Chronographs are Hot

We all know that that refs. 1518s and 2499s bring consistently sky high prices at auction as they reach into the stratosphere. However, we have long been observing the upward trend in results of refs. 3970s and 5970s, so called ‘modern vintage’ perpetual chronographs. During this sale week, we saw some memorable results at auction for ref. 3970s starting with this ref. 3970EP (seen above and below) a platinum second series Archive-only example that brought 214,200 CHF at Phillips.

And then a few days later at Sotheby’s we saw a mint condition, but ‘naked’ with no box and papers ref. 3970EG white gold second series bring 239,400 CHF. These are simply a new level of price point that we have not seen for ref. 3970s before and we will be watching this space closely.

With ref. 5970s, we also saw strong results reflecting the trend we are seeing within the dealer market of a slow and steady increase in prices for all metal colors. It was particularly interesting to see a ref. 5970P bring the same price (264,600 CHF) as a ref. 5970G during the same sale Phillips.

Single Owner Sales Do Not Disappoint

At Christie’s, there was an exciting single owner sale that brought in new bidders and buyers with some fascinating results. This was the collection of Jean Todt, the famous Formula 1 and Ferrari driver. To learn more about this sale please see this link from our friends at Italian Watch Spotter. Of the 111 pieces in this impressive collection, only five were Patek Philippe watches but they offer an insight into how bidding can get aggressive in a single owner collection sale. Of particular note was the 20,000 CHF spent on this Chronometro Gondolo :

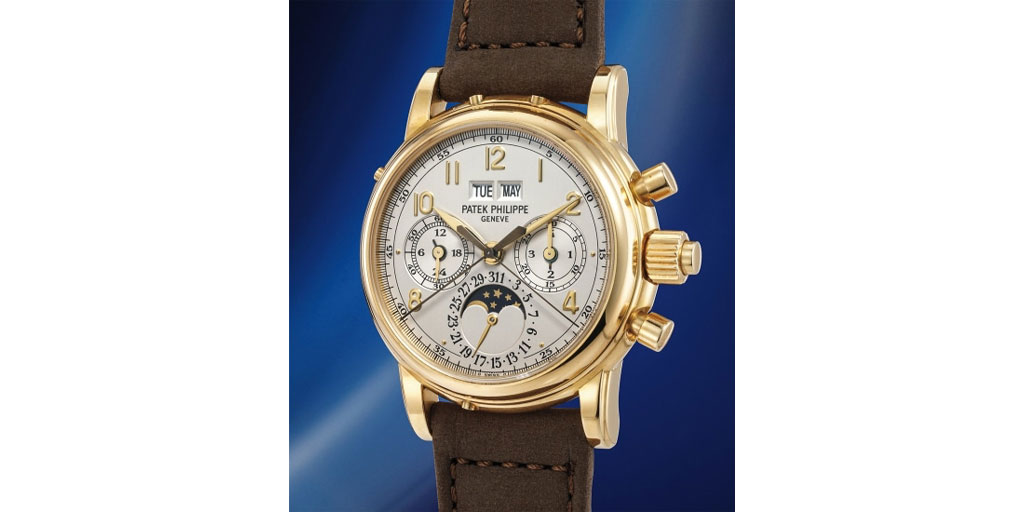

And a significant surprise result was this ref. 5004J seen below that brought 390,000 CHF. What is interesting with this sale is that it shows how emotional bidding for provenance is alive and well in the world of auction.

For point of comparison, this arguably nicer example below of a ref. 5004J brought 277,400 CHF on the same day at Phillips.

In short, provenance continues to make a big difference at auction and never underestimate the wildcard of emotion with buying a watch. To see the entire Jean Todt sale, please click here.

Patek Philippe Steel Sports Watch Prices are in Flux

Nautilus results at all the auction houses were fascinating. Perhaps the most logical results were that of the ref. 5711/1A. Consistently, they are bringing 113,000 CHF across the board. This is a significant decline from the 180,000 CHF we saw a few months ago. However, they are still holding VERY strong relative to their last retail price of just under 40,000 CHF. For a watch with thousands of examples in circulation, perhaps it is not a surprise that buyers know what they want to pay and they have capped their limit for the time being. The results of the classic ref. 5711/1A with dark blue dial might be where the logic ends. The green dial ref. 5711/1A defies logic and is still securing high bids reaching 362,500 CHF at Antiquorum! For those following the prices of these, we doubt this will be a surprise, but it is still a truly strong price for a discontinued, regular production watch made in the hundreds. A quick look at Chrono24 shows over a dozen of these references for sale globally. Not a bad return for a 45,000 CHF watch…

And then there is the Nautilus that had everyone talking — the Tiffany Blue ref. 5711/1A. One of 170 made, this seller decided that money means more than relationships and chose to sell their watch at auction. The sale price? A staggering 3.17 million CHF. I guess a 6000% return on investment warrants ending a relationship with your retailer friends. Word on the street is that less than half of the 170 pieces made for this limited edition have been delivered to Tiffany clients so far. We wonder what will happen to prices once all 170 are delivered? Based on what we have seen so far, over 20 examples of this watch have been flipped by buyers so far. Not to be critical, but it is Collectability’s opinion that supply and demand are going to catch up on this limited edition in the near future. In the meantime, let the buyer beware.

Great Vintage Watches Bring Great Prices

There were many impressive results for vintage watches this season and not many bargains for the taking at auction. Quality vintage pieces slowly and steadily demand a premium and they often do so without making the headlines. Take for example this absolutely stunning ref. 2570/1J Amagnetic watch below with original Certificate of Origin that brought 88,200 CHF. Congrats to the buyer of this one — a gorgeous watch.

Another beauty, this ref. 530 pink on pink seen below brought just over 900,000 CHF. Made circa 1951, this classic Patek Philippe chronograph sports a 36.5 mm case which wears well on today’s wrists.

With vintage, we continue to see quality sells and the best of the best will bring top dollar, no matter what the overall ‘market’ situation appears to be. We certainly saw less ‘big vintage’ Patek watches this season in Geneva, but we are excited to see the action in New York this December, most notable with the BD Howes Third Series ref. 2499. It’s a safe bet we will see some vintage Patek Philippe records fall before the year is finished.

Pocket Watch Collecting is Very Much Alive

Of all the auction houses during this Geneva sale week, Antiquorum certainly had the best and most robust offering of Patek Philippe pocket watches. Some personal favorites include the Patek Philippe below first offered in July 1939 by The Mozambique Company to the General Carmona, President of the Republic of Portugal. The elaborately jeweled coat-of-arms applied to the case-back of the watch was made by a Portuguese goldsmith in Lisbon, as shown by the master and control marks stamped in two places on the décor.

Another favorite pocket watch was this exquisite ref. 738 below which was made in 1921. This type of pocket chronometer is often referred to as a “Deck-Watch” and was made for scientific purposes. Inside its silver case is a collector’s favorite: a Guillaume balance. This watch achieved an Honorable mention in the Bulletin of the Astronomical Observatory of Geneva.

Generally, pocket watch prices are on a stable incline and these still represent the best relative value in Patek Philippe collecting today. A historically important complicated Patek bringing less than a modern production steel Nautilus is a dislocation in the market that will not last forever!

We were delighted to see a recent article in the Financial Times presenting the growing trend for people to wear a pocket watch, or ladies to wear a pendant watch. As the writer Viviane Baker enthused, “As for the pocket watch, a fashion-fuelled re-emergence seems likely.” We certainly agree!

In conclusion, the Patek Philippe market is certainly going through a correction but compared to other collecting segments it remains quite strong. In fact, we kept hearing over and over again that in an uncertain world of declining financial markets, political instability, and crypto crashes, the general sentiment is that Patek Philippe is one thing people can count on. We see that collectors are not scared in troubling times, only investors are scared. This gives a backbone to the Patek Philippe market that is unlike anything else one can buy in the world yesterday, today, and tomorrow.